REQUIREMENTS FOR SEZ RESIDENTS

They can't be residents:

- Legal entities that apply special tax regimes that are provided for by the legislation of the Russian Federation on taxes and fees.

- Financial organizations, including credit and insurance organizations and professional participants in the securities market.

- Logistics companies, advertising agencies, stores, legal agencies, and other service companies.

REQUIREMENTS FOR SEZ INVESTMENT PROJECTS

Dobrograd-1 SEZ territory

1. Mining and related services;

2. Production of ethyl alcohol, alcohol and tobacco products, as well as other excisable goods (except for cars and motorcycles);

3. Wholesale and retail trade;

4. Repair of household appliances and personal goods;

5. Financial activities;

6. Production and distribution of electric energy;

7. Lease of real estate, except for leasing for the production of products in the manufacturing sector.

1. Design and survey work;

2. Construction of new facilities;

3. Technical renovation and modernization of fixed assets;

4. Reconstruction of existing buildings;

5. Purchase of vehicles, machinery, equipment, tools and inventory;

6. Expenses for the purchase and lease of land, buildings and structures, as well as objects of unfinished construction;

1. The sum of the value of property that was transferred to the authorized capital of a resident;

2. Expenses for the acquisition of property that was owned by residents or other persons and for which the corporate property tax rate was previously applied, in accordance with Article 385.1 of the Tax Code of the Russian Federation;

3. Expenses for the purchase of passenger cars, sports cars, tourist and recreational vessels (except for the costs of purchasing sports, tourist and recreational vessels by a resident implementing an investment project in the field of tourism and recreation);

4. Gratuitous transfer and paid transfer of machinery, equipment and vehicles by persons whose state registration was carried out before 01.04.2006 in accordance with the legislation of the Russian Federation;

5. Costs for the purchase, construction and reconstruction of residential premises;

6. Costs of purchasing sports, tourist and recreational vessels by a resident implementing an investment project in the field of tourism and recreation); 6. Paid transfer of property, including a lease agreement, with payment (or provision of installment payments) for a period exceeding three years from the date of inclusion of a resident in the register.

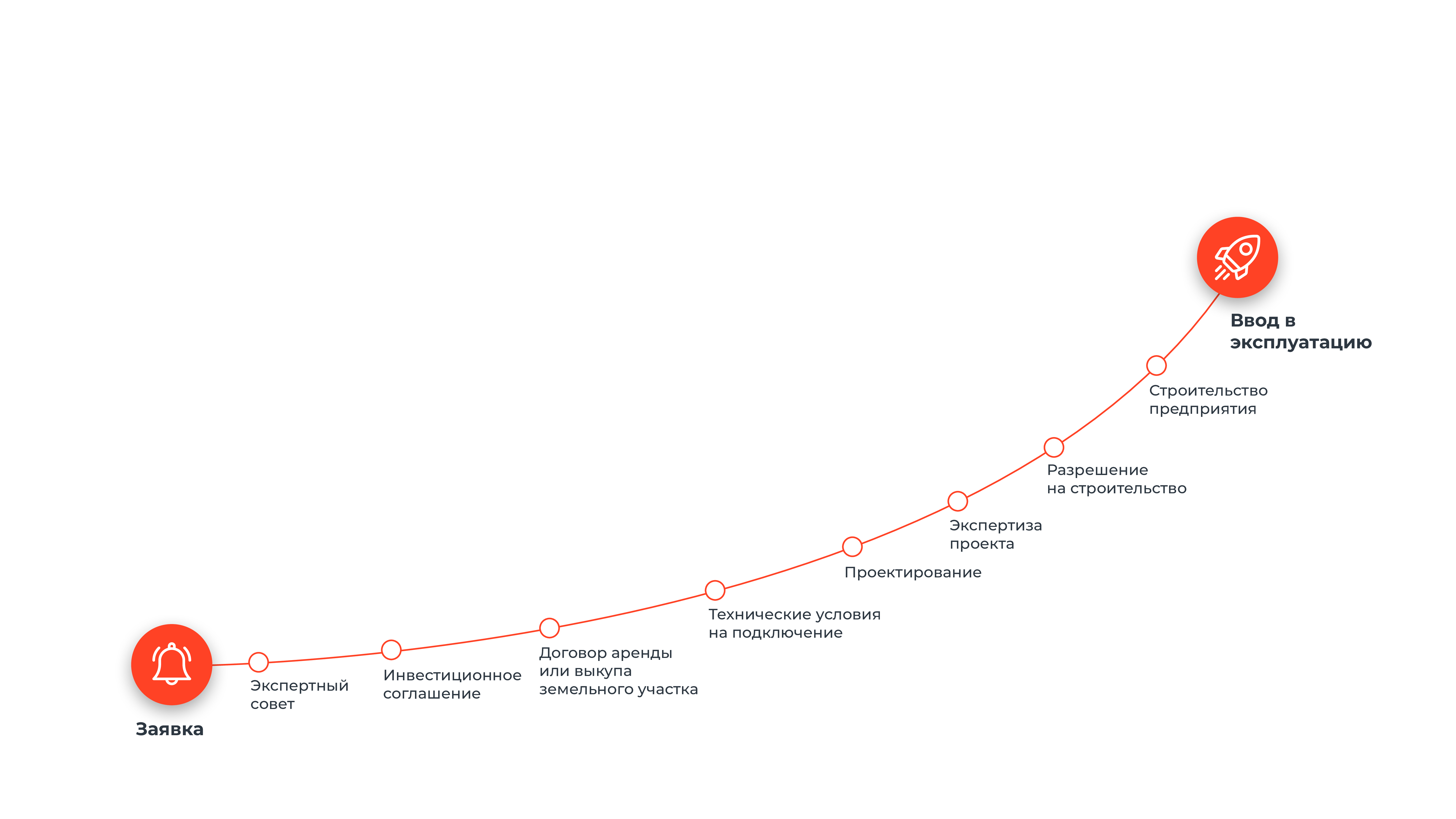

Stages of obtaining SEZ resident status

Required documents

Benefits for SEZ residents

7% - from the 8th to the 12th year

15.5% - from the 13th year

Additional information

Any commercial organization can become a resident of the Dobrograd-1 SEZ, with the exception of a unitary enterprise, which:

- registered within the boundaries of the municipality where the SEZ is located: Vladimir region, Kovrov Municipal district, MO urban settlement Dobrograd settlement;

- conducts industrial and production activities that do not contradict Federal Law No. 116, Article 4, paragraph 5

• mining of minerals is prohibited;

• it is prohibited to work with excisable goods;

- has concluded an agreement with the Administration of the Vladimir Region and the Management Company of the Dobrograd-1 SEZ on the implementation of industrial and production activities, logistics activities, or technical and technical support of the company.- implementation activities in the industrial and production special economic zone in accordance with Federal Law No. 116 of the Russian Federation;

- made capital investments of at least 120 million rubles as part of the implementation of the business plan. At the same time, the company is required to invest 80 million rubles within 3 years from the date of conclusion of the agreement. Funds can be used to purchase any tangible assets: land, equipment, construction of buildings, and so on.

According to Federal Law No. 116 of the Russian Federation, a resident of a special economic zone is required to make capital investments in the amount of at least 120 million rubles as part of the implementation of the business plan, while 80 million rubles must be invested within 3 years from the date of conclusion of the agreement on the implementation of activities.

Funds can be used to purchase any tangible assets: land, equipment, construction of buildings, and so on.

Revocation of a person's status as a resident of a special economic zone is allowed only in court in cases stipulated by Federal Law No. 116 of the Russian Federation, and entails termination of the agreement on the implementation of industrial and production activities, in the event of:

- termination of the resident's business activities ;

- implementation of business activities by the resident that are not provided for in the investment agreement;

- failure to submit accounting documentation

- failure to make mandatory investments, including capital investments;

- in case of early termination of the SEZ's existence

Become a resident!

We will help you solve all the difficulties in a short time and issue the necessary documents.